CLASSIFYING PROPERTY CAPITALIZED PROPERTY

Content

The decision whether to capitalize an asset or not is a critical business issue because it could influence the profits or losses of a business. The P & L results, in turn, can affect the business’s net worth, its tax liability and potentially debt covenants – the financial ratios required by a lender. Capitalization involves “depreciating ” or “amortizing” a portion of the purchase price of an asset at regular intervals over a set period of time. The Property Administration Policy shall set the standards for tagging and tracking fixed assets. This category will be capitalized if cost equals or exceeds $100,000 and an estimated useful life of greater than one year.

A company buying a forklift would mark such a purchase as a cost. An expense is a monetary value leaving the company; this would include something like paying the electricity bill or rent on a building. Companies with a high market capitalization are referred to as large caps; companies with medium market capitalization are referred to as mid-caps, while companies with small capitalization are referred to as small caps. A capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation. Capital investment is the acquisition of physical assets by a business in order to further its long-term goals and objectives. The market value cost of capital depends on the price of the company’s stock.

Free Accounting Courses

The present value of the minimum lease payments at the inception of the lease, excluding executory costs, equals at least 90 percent of the fair value of the leased property. The period during which the item is expected to provide the service for which it was intended. Enter the appropriation capitalized accounting symbol under which the property was acquired. This will be part of the fiscal data on the acquisition document. If the property was acquired as a transfer from another post or U.S. Government agency, it will be necessary to get the appropriation symbol from the transferor.

Enter the allotment symbol as indicated in the fiscal data on the acquisition document. Useful life is generated automatically by approved property system or Integrated Logistics Management System as applicable. Waste and drain piping including pumps, control devices, etc. within a building to the point of exit.

Module 9: Property, Plant, and Equipment

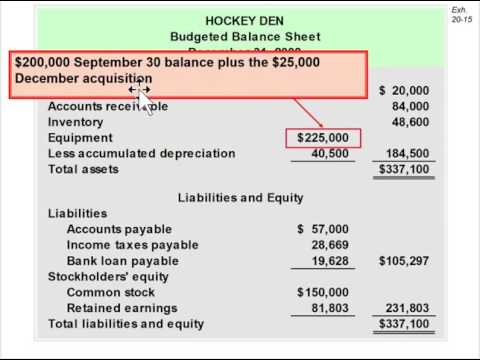

Is the process by which a long-term asset is recorded on the balance sheet and its allocated costs are expensed on the income statement over the asset’s economic life. The accumulated depreciation balance sheet contra account is the cumulative total of depreciation expense recorded on the income statements from the asset’s acquisition until the time indicated on the balance sheet. To capitalize is to record a cost/expense on the balance sheet for the purposes of delaying full recognition of the expense.

- Whether a transaction is expense or capitalized is guided by the matching-principle of accounting.

- Land Improvements with a total cost of $100,000 or greater are capitalized.

- He is the sole author of all the materials on AccountingCoach.com.

- Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content.

- If you expense the equipment today, the full $1,000 is reported immediately against your current income.

Therefore, inventory cannot be capitalized since it produces economic benefits within the normal course of an operating cycle. Although they both represent an outflow of cash, their accounting treatment is significantly different – in order to reflect the substance of the costs. Accrual-based accounting differs from cash-based accounting, where both types of costs are treated the same, and changes on the financial statements only reflect the movement of cash. To defer the cost to the balance sheet is to capitalize the costs.

Capitalized Cost vs. Expense

Scenario one might cause even an experienced accountant to pause for a moment. The answer, of course, is “it depends.” Most likely, your company has a policy stating that items looking like fixed assets are expensed if they are too immaterial to bother with, say, under $500. Even so, if you buy a batch of them, is the $500 for each one, or for the lot? Also, does the company want to track certain items that fall below the materiality threshold anyway, such as tablet computers that might be easily “misappropriated”?

What is an example of capitalized in accounting?

Typical examples of corporate capitalized costs are items of property, plant, and equipment. For example, if a company buys a machine, building, or computer, the cost would not be expensed but would be capitalized as a fixed asset on the balance sheet.